Federal Agency Issues Update On Marijuana Banking Trends As Trump Weighs Rescheduling

In the hazy intersection of policy, profit, and prohibition, the U.S. marijuana industry teeters on the edge of transformation. On September 22, 2025, the Financial Crimes Enforcement Network (FinCEN), a bureau under the U.S. Department of the Treasury, dropped its latest quarterly update on marijuana banking trends—a data dump that reveals a sector stubbornly resilient amid federal illegality. This comes at a pivotal moment: President Donald Trump, fresh off his reelection, has publicly signaled he's "looking at" rescheduling marijuana from Schedule I to Schedule III, a move that could ripple through the $35 billion legal market projected for this year alone. With bipartisan momentum building for the SAFER Banking Act and state-legal sales hitting $30 billion in 2024, these FinCEN figures aren't just numbers; they're a barometer for an industry desperate to escape the cash-stuffed vaults of yesteryear. As Trump mulls his decision—expected within weeks—this update underscores the quiet revolution already underway in marijuana wholesale channels, white-label innovations, and the surge of marijuana smoking online communities.

Cash Shadows and Digital Dawn: Decoding FinCEN's Latest Marijuana Banking Snapshot

Picture this: a bustling dispensary in Denver or Detroit, where daily hauls of $10,000 in crumpled bills pile up behind armored counters, vulnerable to theft and IRS scrutiny. That's the stark reality FinCEN's report illuminates, even as it charts incremental progress. Through December 2024—the latest full dataset—financial institutions filed over 10,000 Suspicious Activity Reports (SARs) tied to marijuana-related businesses (MRBs), a figure that's held steady from 2023's peak of 11,200. But here's the silver lining: 80% of these SARs are tagged as "marijuana limited," signaling compliance with state laws and federal guidance from 2014. This isn't chaos; it's cautious integration.

The numbers paint a portrait of stability in a storm. As of early 2025, 816 banks and 182 credit unions actively service MRBs, up from a mere 70 institutions in 2014 when recreational legalization was a novelty in Colorado and Washington. That's a 1,000% surge in participation, yet disparities scream across states: California leads with 2,500+ SARs quarterly, thanks to its $5.3 billion annual sales juggernaut, while nascent markets like Ohio log under 200. Credit unions, often community-rooted, now handle 15% of all filings, a trend FinCEN attributes to their lower risk appetite compared to national banks like JPMorgan, which still steer clear.

This relative calm belies deeper tensions. The cash-only model persists for 40% of MRBs, per industry surveys, fueling a shadow economy where $15 billion in untaxed sales evades regulators. FinCEN's state-by-state breakdown, a new addition to its 10-year retrospective spreadsheet, highlights hotspots: Illinois and Michigan each exceed 1,000 SARs, driven by robust marijuana wholesale networks supplying multi-state operators. Yet, "marijuana priority" SARs—flagging potential illicit activity—rose 5% year-over-year to 12%, a red flag for enforcement hawks. As one FinCEN analyst noted in a rare comment, "These metrics show banks are adapting, but prohibition's ghost lingers, inflating compliance costs by 20-30% for cannabis clients."

For businesses, the implications are immediate. Higher fees—averaging $5,000 annually per account—stifle growth, particularly in marijuana white label ventures where startups rebrand bulk product without the overhead of cultivation. Imagine a fledgling Colorado firm sourcing from a licensed grower, slapping on its logo, and shipping nationwide: without seamless banking, payments lag, and opportunities evaporate. FinCEN's data, retroactive to Obama's 2014 guidance, proves the system's evolution—from outright avoidance to selective embrace—but it's a half-measure. With global cannabis investments topping $100 billion by 2025, per Whitney Economics, the U.S. risks ceding ground to Canada's fully banked $10 billion market.

Trump's High-Stakes Poker: Rescheduling Marijuana in a Post-Biden World

Enter Donald J. Trump, the dealmaker-in-chief, whose August 2025 White House briefing ignited speculation. "We're looking at reclassification," he declared, eyeing a shift from Schedule I—deemed as dangerous as heroin—to Schedule III, akin to ketamine or anabolic steroids. This Biden-era proposal, stalled by DEA appeals and a canceled January hearing, now sits on Trump's desk, with a decision teased for "the next few weeks." It's a U-turn from his first term's inaction, perhaps nudged by 87% public support for legalization (Pew Research, 2025) and donors whispering of untapped billions.

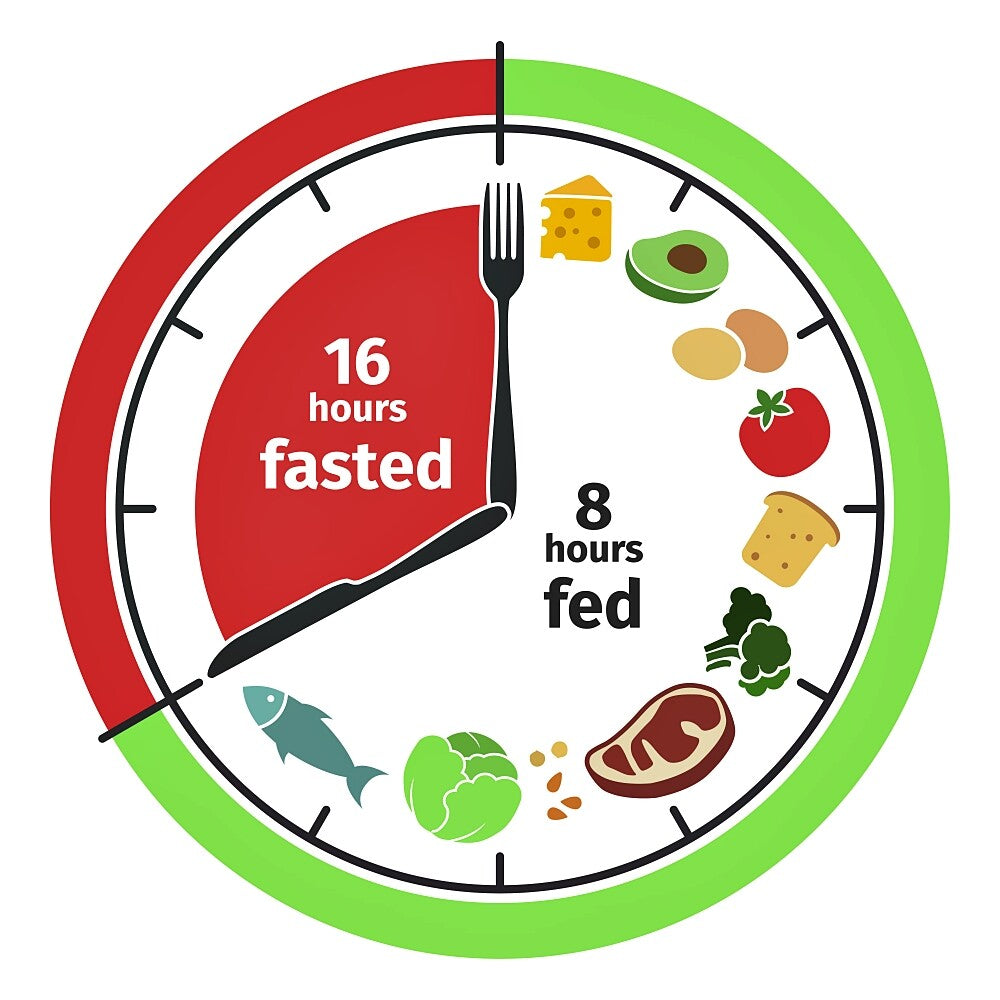

Rescheduling wouldn't legalize recreational use—24 states already have—but it would dismantle barriers. Tax code Section 280E, which bars deductions for "trafficking" businesses, devours 70% effective rates for many MRBs; Schedule III could unlock ordinary deductions, injecting $2-3 billion in annual savings, estimates the Marijuana Policy Project. Research explodes too: Schedule I throttles clinical trials, but III status greenlights pharma partnerships, potentially validating marijuana smoking online as a viable wellness ritual rather than a Schedule I sin.

Politically, it's Trump's gambit. Allies like Rep. Greg Steube (R-FL) reintroduced the Marijuana 1-to-3 Act in September, aligning with Trump's states'-rights rhetoric. Yet opposition brews: 50 GOP lawmakers penned a letter to Attorney General Pam Bondi decrying it as a "giveaway to Big Marijuana," echoing Ben Carson's op-ed warning of urban crime spikes. Trump's nominee for drug czar, Sara Carter, hedged during confirmation: "All options on the table, but data first." With House Republicans advancing a 2026 funding bill to block DOJ rescheduling funds, the clock ticks. If Trump greenlights it, expect a 90-day comment period and rulemaking by mid-2026—too late for 2025's $35.2 billion sales projection, but a beacon for marijuana wholesale scalability.

The wildcard? Banking. Even rescheduled, cannabis remains federally controlled, per ABA warnings. Trump's pivot could supercharge SAFER, which passed the Senate Banking Committee 14-9 in 2023 but stalled. Bipartisan AGs from 32 states urged its passage in July 2025, citing $34 billion in projected sales and 75% of Americans in legal jurisdictions. Without it, rescheduling's promise fizzles: banks still file SARs, insurers balk, and loans dry up.

Wholesale Whispers: How Banking Bottlenecks Squeeze the Supply Chain

Deep in the marijuana wholesale ecosystem, FinCEN's update is less abstract—it's existential. Bulk deals, where growers offload pounds at $975 per pound (April 2025 futures, down 5% from 2024), rely on wire transfers that 60% of wholesalers say are "unreliable" due to bank hesitancy. California's 2,500 SARs reflect a mature chain: from Humboldt's sun-kissed fields to L.A. processors, $3.2 billion flows annually. But smaller players in emerging markets like Virginia—where sales hit $500 million in 2024—face 25% higher rejection rates from FIs, per Green Growth CPAs.

This squeeze manifests in "survival mergers": Curaleaf's 2025 buyout of Grassroots for $150 million consolidated supply, but independents fold at 15% quarterly. Pricing gaps widen too—indoor flower at $1,200/pound vs. outdoor at $700—exacerbating cash hoarding. Enter marijuana white label as a lifeline: brands like Wana pay premiums for pre-packaged edibles, bypassing cultivation woes. Yet, without banking parity, these deals snag on delayed payments, costing 10-15% in lost revenue. FinCEN's 80% "limited" SAR rate reassures some lenders, but the 20% "termination" filings—up 3%—signal volatility. As one wholesaler quipped, "We're wholesaling dreams, but banking on nightmares."

Projections? If SAFER passes by year's end—as Herring Bank forecasts—wholesale volumes could swell 20%, hitting $12 billion nationally. Trump's rescheduling nod might tip that to 30%, easing interstate hints. For now, trends favor consolidation: MSOs control 60% of wholesale, per First Citizens' 2025 report, leaving niches for agile white-label innovators.

Virtual Puffs: The Online Smoking Scene Redefines Consumption

While wholesalers grind, consumers puff ahead—digitally. Marijuana smoking online isn't just forums; it's a $2 billion e-commerce slice, with platforms like Leafly logging 50 million monthly visits in 2025. FinCEN's data indirectly boosts this: as physical banking lags, digital payments via fintech (e.g., Hypur) process 40% of online orders, skirting SAR scrutiny. With 15% of Americans (Gallup 2025) as regular users—up from 14% in 2022—online sales jumped 25% year-over-year, fueled by Gen Z's 34% alcohol-to-cannabis swap rate.

Trends skew experiential: virtual reality "smoke sessions" on Discord pair with white-label vapes, blending community and commerce. Delivery drones in California testbeds promise 30-minute fulfillment, while eco-packaging for online bundles—biodegradable for $1 extra—caters to millennials' 46% market share. Risks lurk: interstate shipping remains federally dicey, capping growth at 15% in prohibition states where delta-8 proxies thrive.

Banking ties in crucially—online sellers face 35% account closure rates, per FinCEN, pushing cash apps like Venmo into gray zones. Rescheduling could normalize this, unlocking $5 billion in e-sales by 2027. Trump's weigh-in? A Schedule III greenlight legitimizes online education on strains, turning "smoking" from taboo to tutorial.

Beyond the Bill: Rescheduling's Ripple Effects on Banking and Beyond

As FinCEN's ledger closes Q3 2025, the industry's pulse quickens. Rescheduling promises 280E relief—$1.5 billion saved for top MSOs—while SAFER could onboard 500 more banks, slashing cash risks by 50%. State AGs' July letter nailed it: regulated banking boosts tax hauls to $15.6 billion globally by 2025, with U.S. leading.

Yet challenges persist: illicit markets claim 40% share, and GOP blocks loom. Trump's decision—due imminently—could catalyze or crater momentum. For marijuana wholesale titans, white-label upstarts, and online smoking pioneers, it's a bet on federal thaw. In this green rush, data doesn't lie: 816 banks today, but thousands tomorrow? The numbers, and Trump, will tell.

In a $35B marijuana market poised for federal rescheduling under Trump, D Squared Worldwide delivers seamless wholesale excellence. Source top-tier flower at $975/lb futures pricing, or dive into our innovative marijuana white label program—rebrand premium bulk edibles and vapes without cultivation headaches. Bypass banking bottlenecks with our fintech-integrated payments, ensuring reliable wires even amid FinCEN's SAR scrutiny. As online smoking communities boom with 25% e-sales growth, scale your reach effortlessly. Join MSOs controlling 60% of wholesale—don't get left in the cash shadows.

Ready to consolidate and thrive? Schedule a call today at d2worldwide.com/call to customize your supply chain and seize 20-30% growth potential!

Reference:

1. Clarke, R. (2021). Navigating the us “green rush”: anti-money laundering and de-risking implications for banking cannabis-related businesses in jamaica. Journal of Financial Crime, 29(2), 564-575. https://doi.org/10.1108/jfc-10-2021-0235

2. Enos, G. (2025). Possible rescheduling of marijuana leaves many questions unanswered. Alcoholism & Drug Abuse Weekly, 37(33), 1-7. https://doi.org/10.1002/adaw.34632

Neuman, M., Hennessy, S., Small, D., Newcomb, C., Gaskins, L., Brensinger, C., … & Wunsch, H. (2020). Drug enforcement agency 2014 hydrocodone rescheduling rule and opioid dispensing after surgery. Anesthesiology, 132(5), 1151-1164. https://doi.org/10.1097/aln.0000000000003188